April's San Francisco HCSO Reporting for 2019 Cancelled

By Karen Hooper | Published April 3, 2020

No 2019 Annual Report

COVID-19 has turned the world upside down. Mayor London Breed issued a supplement dated February 25, 2020 to the Emergency Proclamation stating that the work required to compile and report the data necessary would require some employers to engage in non-essential travel to their places of business and would place further economic strain on employers.

Therefore, the standard April 2020 requirement for employers to report 2019 health care expenditures is waived.

What about the other Employer Obligations under the HCSO?

Even though the requirement to report for the 2019 calendar year has been suspended, covered employers are still required to make any required health care expenditures to the City Option for the first quarter 2020 by April 30, 2020.

See our previous post for more details: SF HCSO City Option Contributions

Who is a Covered Employer?

You are a covered employer and are required to make health care expenditures if you met the following three conditions in 2020:

employed one or more workers within the geographic boundaries of the City and County of San Francisco;

were required to obtain a valid San Francisco business registration certificate pursuant to Article 12 of the Business and Tax Regulations Code,

employed 20 or more persons worldwide (for profit) a nonprofit organization that employed 50 or more persons worldwide.

What are the Employer Obligations under HCSO?

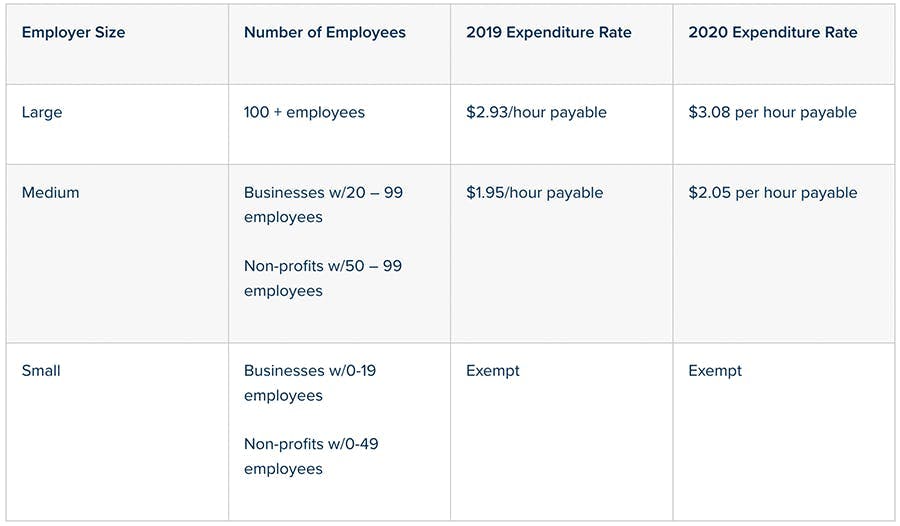

Satisfy the Employer Spending Requirement by making required health care expenditures on a quarterly basis on behalf of all covered employees (generally those who have been employed for more than 90 days, regularly work at least 8 hours per week in San Francisco, and for whom no exception applies) at the following rates:

Maintain records sufficient to establish compliance with the employer spending requirement

Post an HCSO Notice in all workplaces with covered employees

Submit the Annual Reporting form by April 30each year.

Which Employees are Exempt or Excluded from Eligibility under the HCSO?

There are five categories of exempt employees:

Employees who sign a waiver form and voluntarily waive their right to have employers make Health Care Expenditures for their benefit.

Employees who qualify as Managers, supervisors or confidential employees AND earn more than the applicable salary exemption amount.

Employees who are covered by Medicare or Tricare.

Employees who are employed by a non-profit corporation as a trainee in a bona fide training program.

Employees who receive health care benefits pursuant to the San Francisco Health Care Accountability Ordinance (HCAO)

A Reminder about the Waiver Form

The Employee Voluntary Waiver Form permits employees to voluntarily waive their right to employer health care expenditures under the HCSO. Employers must use the exact form and may not change the form in any way.

For more information on all of the HSCO requirements, check out the SF OLSE’s official HSCO website.

For more information, see our Newfront San Francisco Health Care Security Ordinance (HCSO) Guide.

Karen Hooper

VP, Senior Compliance Manager

Karen Hooper, CEBS, CMS, Fellow, is a Vice President and Senior Compliance Manager working closely with the Lead Benefit Counsel in Newfront's Employee Benefits division. She works closely with internal staff and clients regarding compliance issues, providing information, education and training.