Brexit Update and the Impact on Clinical Trials Insurance

By Cristina Varner | Published January 28, 2021

Four and a half years following the Brexit referendum, the United Kingdom is now operating in a post-Brexit environment. Due to the loss of passporting rights, Lloyd’s of London, who manages a large portion of foreign clinical trial policies, has transferred all of its European Economic Area (EEA) written business to Lloyd’s Insurance Company S.A.

As part of the deal, the United Kingdom and EU have agreed to recognize each other’s quality standards and inspections of medicines, which means that extra safety checks will not be needed when moving drugs over the border. That should minimize any disruption of supply, including products being tested in clinical trials.

Part VII of the “Financial Services and Markets Act 2000” requires transfer of insurance business to be elected by an insurance business transfer scheme sanctioned by the High Court of England and Wales.

Part VII currently allows for the transfer of insurance business from a regulated UK insurer to an EEA insurer without the need for individual policy replacement or policyholder consent. Part VII also covers Lloyd’s of London business.

It is a common legal mechanism used for restructuring insurance business, in this case allowing for EEA non-life risks to transfer and for EEA non-life risks to be split from non-EEA risks and transferred to Lloyd’s Brussels. Part VII has been used by many other UK insurers in the context of Brexit to transfer EEA insurance policies to European insurers.

The transfer will help ensure EEA policies can be compliantly serviced after Brexit, including the payment of claims. The proposed transfer will not change policy terms and conditions, except that Lloyd’s Brussels will become the insurer and data controller in respect of EEA policies.

The transfer has been carefully designed to ensure that it will not change how policies operate. Life science companies will see no direct administrative change as a result of the transfer.

For UK-led trials, they will require the sponsor or legal representative of a clinical trial to be in the UK or country on an approved country list (this will initially include the EU/EEA countries). For ongoing trials, the UK will accept a sponsor or legal representative established in the EU/EEA, and no amendment submission to the Medicines & Healthcare Regulatory Agency (MHRA) will be required.

If the sponsor is from the rest of the world, and the legal representative is established in the UK and there are sites elsewhere in the EU/EEA, the sponsor will need to assign an EU/EEA legal representative for these EU/EEA sites.

As always, ABD’s Life Science Practice is available to answer any questions you many have and will continue to provide important updates affecting life science companies.

Cristina Varner

National Life Science & Healthcare Practice Leader

Cristina Varner is the Life Science Practice Leader, leading a team of experienced account management professionals that service approximately 300 life science accounts. With 20+ years in the risk management field, Cristina is one of the industry’s foremost experts in complex Product Liability exposures and Clinical Trials insurance all over the world. She is the founder of the Life Science Practice at both her former employer and Newfront, deploying her vast experience with life science companies from start-up to grown up.

Connect with Cristina on LinkedInRelated articles

Casualty 2024 Outlook: Emerging Risks and Ongoing Coverage Concerns

April 12 • 2024

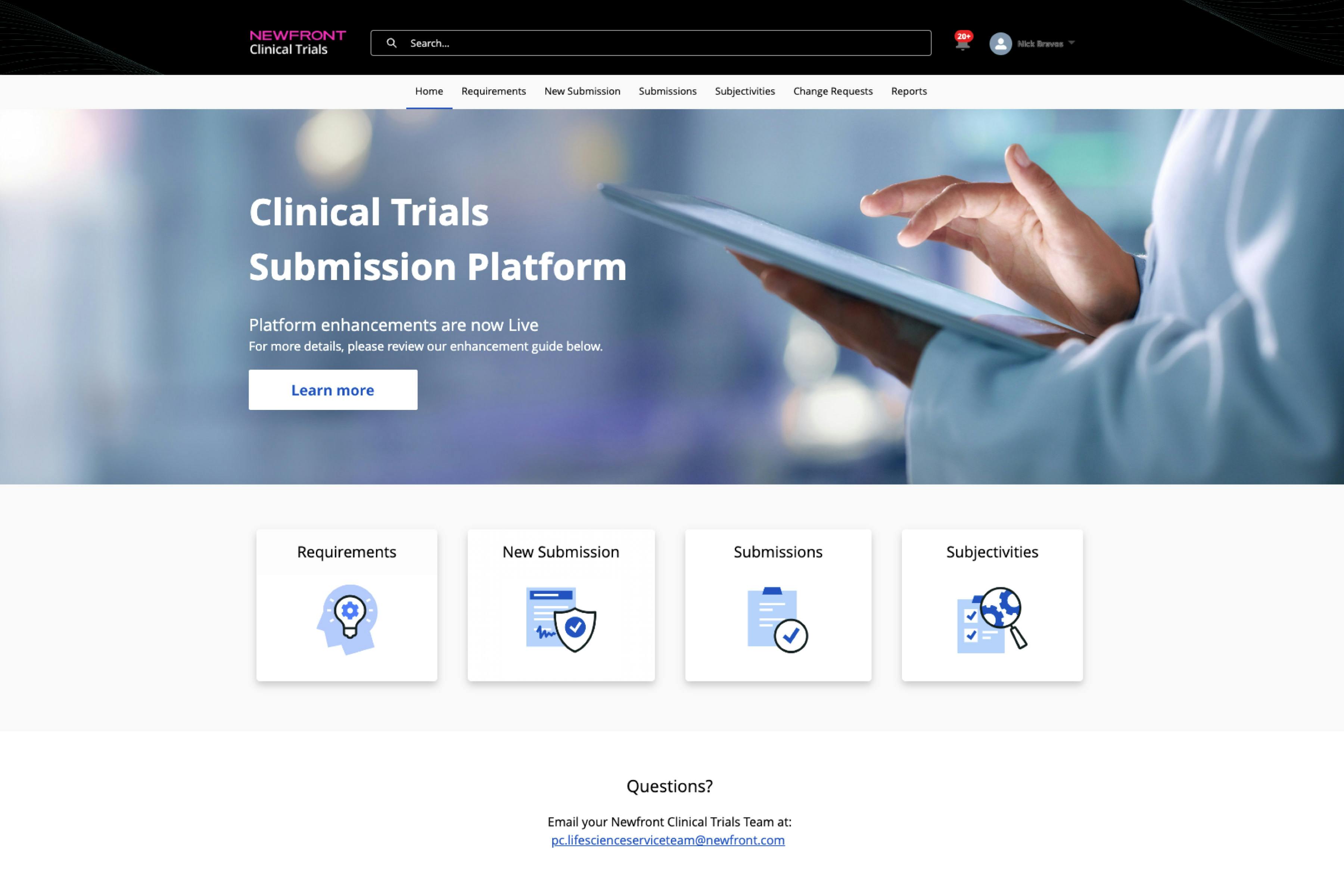

Newfront Clinical Trial Portal Unveils Enhanced Brand Interface and Feature Set

December 6 • 2023

Pharma's Almanac: In what areas of pharma/biopharma are you most excited to see increased adoption of artificial intelligence (AI) and machine learning?

August 8 • 2023