Common Summer Intern Approaches Under the ACA

By Brian Gilmore | Published May 31, 2019

Question: What are some common options for employers in deciding how and when to offer health plan coverage to summer interns?

Compliance Team Response:

ACA Employer Mandate General Rule: New Full-Time Hires

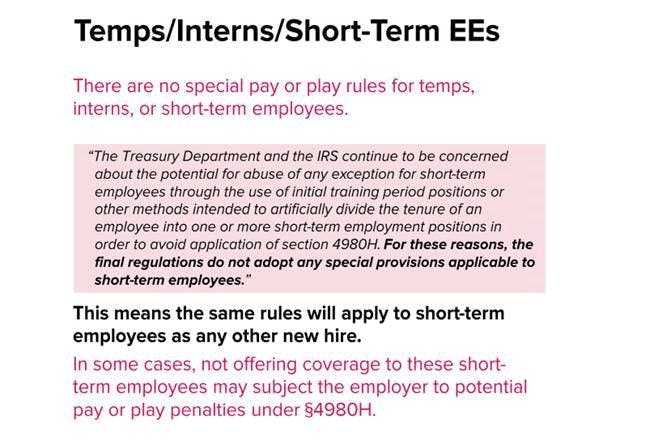

The ACA employer mandate pay or play rules permit a standard limited non-assessment period for new full-time hires.

That limited non-assessment period generally provides that employers will avoid potential ACA employer mandate pay or play penalties as long as they offer coverage to a new full-time employee that is effective no later than the first day of the fourth full calendar month of employment.

More details on the general ACA rules for summer interns:

How Employers Commonly Approach Summer Intern Offers of Coverage

Many employers choose to offer coverage to new full-time summer interns in the same manner as any other full-time hire. That is of course an option, and generally the simplest approach administratively where budget is not a primary concern. Summer interns frequently decline to enroll regardless because of other coverage available through a school, parent, spouse, or domestic partner.

For employers that choose to first utilize the limited non-assessment period before offering coverage to summer interns (i.e., offer coverage that is effective no later than the first day of the fourth full calendar month of employment), there are a variety of common approaches:

Most common—Full Suite of Benefits: The most common approach we have seen is to simply offer the full suite of benefits to summer interns as regular full-time employees no later than the first day of the fourth full calendar month of employment. In this sense, the only difference in the approach between a summer intern and a regular full-time hire is the delay in offering coverage. For employers that utilize the full limited non-assessment period, many interns never receive an offer of coverage because they have returned to school prior to reaching a first day of a fourth full calendar month of employment (i.e., summer intern employment durations frequently do not extend beyond three full calendar months).

Common—Offer Only Medical Coverage: Another common approach is to offer only medical coverage to the summer interns no later than the first day of the fourth full calendar month of employment. The summer interns are not eligible for other coverage (e.g., dental or vision) or under this approach. There are no potential penalty concerns because the ACA employer mandate rules apply only to the employer’s offer of medical coverage.

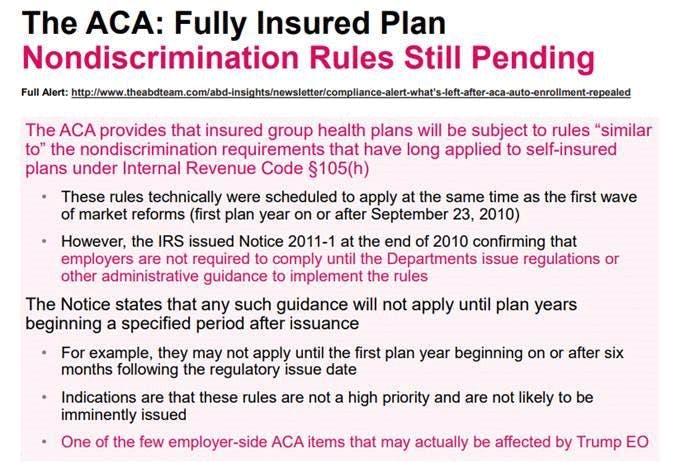

Common—Offer Only Certain Medical Plan Option(s): A third common approach is to offer only one or a select few of the health plan’s fully insured medical options to summer interns. For example, only the lowest-cost HMO is available to full-time interns upon completion of the limited non-assessment period. This approach does not present any compliance issues because there are currently no nondiscrimination rules in effect for fully insured health plans (pending indefinite delay of the ACA fully insured nondiscrimination rules).

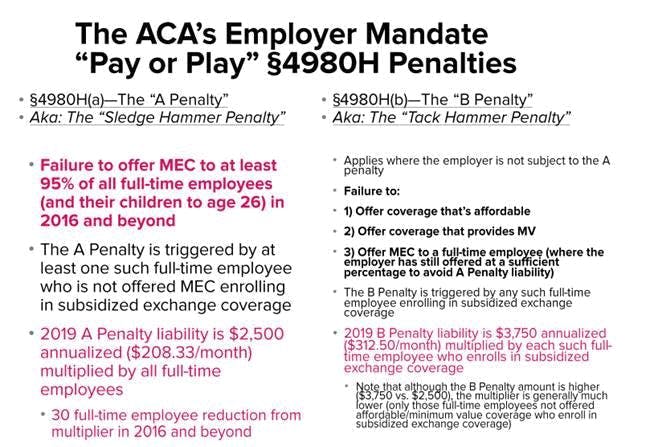

Less common—Accept “B Penalty” Liability: A less common approach we have seen employers take is to simply accept the potential ACA employer mandate “B Penalty” liability for summer interns. That B Penalty liability is generally going to be less than the employer-share of the premium for the lowest-cost medical plan if the intern enrolled. This approach is less common because employers need to be VERY CAREFUL never to jeopardize the plan’s 95% offer of coverage threshold, which could trigger the much larger “A Penalty.” Full-time interns count toward the 95% A Penalty threshold if not offered coverage by the end of the limited non-assessment period!

Note of Caution re Contributions: For any plan options made available to interns, employers will generally need to provide the interns with the same employer contribution available to regular full-time employees to avoid violating the Section 125 nondiscrimination rules. See our previous post ACA Requirements for Offering Coverage Summer Interns for more details.

Note of Caution re Seasonal Employees: Employers that utilize the look-back measurement method to determine employees’ full-time status may be able to classify summer interns as “seasonal employees,” which permits a far longer limited non-assessment period (in the form of an initial measurement period and initial administrative period ) of up to 13 months, plus a partial month for a mid-month hire. Employers utilizing the monthly measurement method to determine employees’ full-time status do not have this option.

Newfront ACA Employer Mandate Pay or Play and ACA Reporting Guide

Brian Gilmore

Lead Benefits Counsel, VP, Newfront

Brian Gilmore is the Lead Benefits Counsel at Newfront. He assists clients on a wide variety of employee benefits compliance issues. The primary areas of his practice include ERISA, ACA, COBRA, HIPAA, Section 125 Cafeteria Plans, and 401(k) plans. Brian also presents regularly at trade events and in webinars on current hot topics in employee benefits law.

Connect on LinkedIn