Employee HSA Rollovers and Transfers

By Brian Gilmore | Published March 6, 2020

**Question: **What are the rules governing employee HSA rollovers and transfers?

**Short Answer_: _ **Within the restrictions imposed by the IRS (which depend on whether the distribution is a rollover or a transfer), employees can freely move their HSA assets to a new custodian at any time and for any reason.

General Rule: HSA Rollovers and Transfers are Not Subject to Taxation

Non-medical HSA distributions are subject to ordinary income taxes, plus a 20% additional tax for individuals under the age of 65. However, these taxes do not apply to a HSA rollover or transfer. Rollovers and transfers also do not apply to the annual HSA contribution limit.

This means that moving HSA funds to another HSA bank does not cause any adverse tax consequences, as long as the HSA holder follows the applicable IRS requirements. The HSA rollover and transfer rules are similar to those that apply to an IRA.

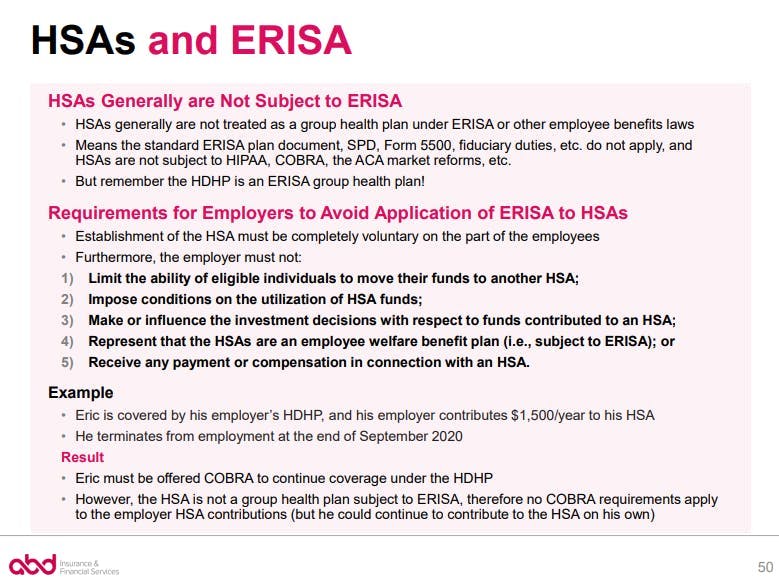

Employers Cannot Limit Ability of Employees Move Funds to Another HSA

Although employers typically require that employees establish an HSA with the employer’s designated HSA custodian in order to make or receive HSA contributions through payroll, the employee’s HSA is not an employer-sponsored plan and is therefore not subject to ERISA. While it is theoretically possible for an employer to make an HSA subject to ERISA, it is extraordinarily rare because the compliance burden would generally be insurmountable.

The result is that employees have complete ownership and control of the HSA as their own personal account. As one aspect of this personal and non-ERISA HSA ownership, DOL guidance prohibits employers from limiting the ability of employees to roll over or transfer their funds to another HSA.

Summary: Employers generally do not permit employer or employee HSA contributions through payroll outside of the employer’s chosen HSA bank. However, employees can freely move any such HSA assets in those accounts to any other HSA maintained by any other HSA custodian via a rollover or transfer.

HSA Rollovers: 60-Day Rule and One-Per-Year Rule

An HSA rollover occurs where the employee receives a distribution from the original HSA account and then re-deposits the assets in a second HSA established by the employee with a different custodian.

There are two main rules associated with HSA rollovers:

60-Day Rule: The employee must deposit the rollover assets in the second HSA within 60 of its distribution from the original HSA; and

One-Per-Year Rule: The employee can make only one rollover contribution to an HSA during each one-year period.

HSA Transfers: No Annual Limitations

An HSA transfer occurs where the original HSA custodian directly moves the HSA funds to the second HSA established by the employee with a different custodian. The employee has no access to the assets in the transfer process and therefore is not responsible for completing the process within a set timeframe. HSA transfers are also frequently referred to as a “direct transfer” or a “trustee-to-trustee transfer”.

Outside the practical limitations described below, there are no limits on the number of HSA transfers an employee can complete. The once-per-year rule for HSA rollovers does not apply to an HSA transfer because the employee does not have access to the funds in the process.

Practical Limitations on HSA Rollovers and Transfers

Although employees may prefer another HSA custodian, there are a few practical limitations on how frequently they may choose to move assets to another HSA custodian:

The HSA bank may require a minimum balance to avoid fees;

It can be administratively burdensome for employees to complete paperwork to roll over or transfer HSA funds on a frequent basis;

The HSA bank may apply fees to each rollover or transfer to another HSA.

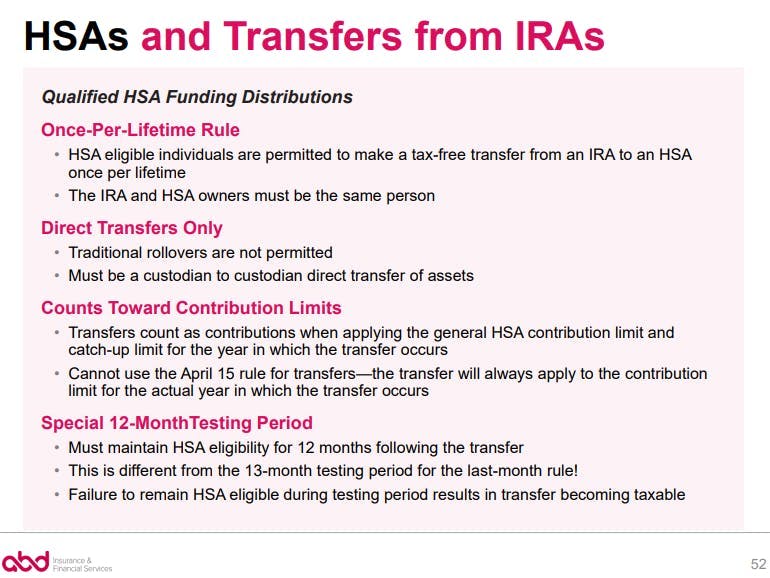

Other Forms of HSA Transfers: Qualified HSA Funding Distributions (QHFDs) from an IRA

HSA eligible individuals are permitted to make a tax-free transfer from an IRA to an HSA once-per-lifetime. The IRA owner and HSA owner must be the same person, and the process must be handled via a transfer directly from the IRA custodian to the HSA custodian (i.e., rollovers are not permitted). These IRA to HSA transfers are referred to as “Qualified HSA Funding Distributions” or “QHFDs”.

QHFDs count as contributions when applying the general HSA contribution limit ($3,550 individual , $7,100 family in 2020) and the catch-up limit ($1,000) for the year in which the transfer occurs. There is also no option to designate a QHFD for the prior year if made by April 15 as with a standard HSA contribution—the QHFD will always apply to the contribution limit for the actual year in which the transfer occurs.

A special testing period requires the individual making a QHFD to maintain HSA eligibility for 12 months following the transfer. The QHFD amount will become taxable for individuals who fail to remain HSA-eligible during the 12-month QHFD testing period.

Additional QHFD Notes:

The 12-month QHFD testing period is a different testing period from the 13-month last-month rule testing period. For more details, see our previous post: The Last Month Rule.

Individuals who reside in California or New Jersey may encounter adverse state income tax consequences related to QHFDs. For more details, see our pervious post: California and New Jersey HSA State Income Tax.

Other Forms of HSA Transfers: Qualified HSA Distributions (QHDs) from a Health FSA or HRA (No Longer Permitted)

The Tax Relief and Health Care Act of 2006 (TRHCA) permitted a special form of HSA transfers referred to as “Qualified HSA Distributions” or “QHDs” from the date of its enactment (December 20, 2006) through the end of 2011.

The QHD rules permitted transfers from the employee’s health FSA or HRA to the employee’s HSA. For a number of reasons, including the complexity of the rules surrounding the process, employers seldom offered QHDs as an option during the limited timeframe in which they were permitted.

QHDs are no longer permitted. TRHCA permitted QHDs only through December 31, 2011.

For more information on everything HSA, see our Newfront Go All the Way With HSA Guide.

Regulations

IRC §223(f)(5):

(5) Rollover contribution.

An amount is described in this paragraph as a rollover contribution if it meets the requirements of subparagraphs (A) and (B).

(A) In general. Paragraph (2) shall not apply to any amount paid or distributed from a health savings account to the account beneficiary to the extent the amount received is paid into a health savings account for the benefit of such beneficiary not later than the 60th day after the day on which the beneficiary receives the payment or distribution.

(B) Limitation. This paragraph shall not apply to any amount described in subparagraph (A) received by an individual from a health savings account if, at any time during the 1-year period ending on the day of such receipt, such individual received any other amount described in subparagraph (A) from a health savings account which was not includible in the individual’s gross income because of the application of this paragraph.

IRS Notice 2004-50:

https://www.irs.gov/irb/2004-33_IRB#NOT-2004-50

VII. Rollovers

Q-55. How frequently may an account beneficiary make rollover contributions to an HSA under section 223(f)(5)?

A-55. An account beneficiary may make only one rollover contribution to an HSA during a 1-year period. In addition, to qualify as a rollover, any amount paid or distributed from an HSA to an account beneficiary must be paid over to an HSA within 60 days after the date of receipt of the payment or distribution. But see Q&A 78 regarding trustee’s or custodian’s obligation to accept rollovers. See also Notice 2004-2, Q&A 23 for additional rules on rollovers.

Q-56. Are transfers of HSA amounts from one HSA trustee directly to another HSA trustee (trustee-to-trustee transfers), subject to the rollover restrictions?

A-56. No. The rules under section 223(f)(5) limiting the number of rollover contributions to one a year do not apply to trustee-to-trustee transfers. Thus, there is no limit on the number of trustee-to-trustee transfers allowed during a year.

DOL Field Assistance Bulletin 2004-01:

https://www.dol.gov/agencies/ebsa/employers-and-advisers/guidance/field-assistance-bulletins/2004-01

Accordingly, we would not find that employer contributions to HSAs give rise to an ERISA-covered plan where the establishment of the HSAs is completely voluntary on the part of the employees_** and the employer does not: (i) limit the ability of eligible individuals to move their funds to another HSA beyond restrictions imposed by the Code; (ii) impose conditions on utilization of HSA funds beyond those permitted under the Code**_; (iii) make or influence the investment decisions with respect to funds contributed to an HSA; (iv) represent that the HSAs are an employee welfare benefit plan established or maintained by the employer; or (v) receive any payment or compensation in connection with an HSA.

DOL Field Assistance Bulletin 2006-02:

https://www.dol.gov/agencies/ebsa/employers-and-advisers/guidance/field-assistance-bulletins/2006-02

In the absence of an employee’s affirmative consent, may an employer open an HSA for an employee and deposit employer funds into the HSA without violating the condition in the FAB that requires that the establishment of an HSA by an employee be “completely voluntary”?

Yes. The intended purpose of the “completely voluntary” condition in FAB 2004-01 is to ensure that any contributions an employee makes to an HSA, including salary reduction amounts, will be voluntary. HSA account holders have sole control and are exclusively responsible for expending HSA funds and generally may move the funds to another HSA or otherwise withdraw the funds. The fact that an employer unilaterally opens an HSA for an employee and deposits employer funds into the HSA does not divest the HSA accountholder of this control and responsibility and, therefore, would not give rise to an ERISA-covered plan so long as the conditions described in FAB 2004-01 are met.

IRS Publication 969:

https://www.irs.gov/pub/irs-pdf/p969.pdf

Rollovers

A rollover contribution isn’t included in your income, isn’t deductible, and doesn’t reduce your contribution limit.

Archer MSAs and other HSAs.

You can roll over amounts from Archer MSAs and other HSAs into an HSA. You don’t have to be an eligible individual to make a rollover contribution from your existing HSA to a new HSA. Rollover contributions don’t need to be in cash. Rollovers aren’t subject to the annual contribution limits.

You must roll over the amount within 60 days after the date of receipt. You can make only one rollover contribution to an HSA during a 1-year period.

Note.

If you instruct the trustee of your HSA to transfer funds directly to the trustee of another of your HSAs, the transfer isn’t considered a rollover. There is no limit on the number of these transfers. Don’t include the amount transferred in income, deduct it as a contribution, nor include it as a distribution on Form 8889.

…

Qualified HSA funding distribution.

A qualified HSA funding distribution may be made from your traditional IRA or Roth IRA to your HSA. This distribution can’t be made from an ongoing SEP IRA or SIMPLE IRA. For this purpose, a SEP IRA or SIMPLE IRA is ongoing if an employer contribution is made for the plan year ending with or within the tax year in which the distribution would be made.

The maximum qualified HSA funding distribution depends on the HDHP coverage (self-only or family) you have on the first day of the month in which the contribution is made and your age as of the end of the tax year. The distribution must be made directly by the trustee of the IRA to the trustee of the HSA. The distribution isn’t included in your income, isn’t deductible, and reduces the amount that can be contributed to your HSA. The qualified HSA funding distribution is shown on Form 8889 for the year in which the distribution is made.

You can make only one qualified HSA funding distribution during your lifetime. However, if you make a distribution during a month when you have self-only HDHP coverage, you can make another qualified HSA funding distribution in a later month in that tax year if you change to family HDHP coverage. The total qualified HSA funding distribution can’t be more than the contribution limit for family HDHP coverage plus any additional contribution to which you are entitled.

IRS Notice 2008-51:

https://www.irs.gov/irb/2008-25_IRB#NOT-2008-51

Maximum amount of qualified HSA funding distribution

For purposes of § 408(d)(9)(C)(i), a qualified HSA funding distribution from the IRA or Roth IRA of an eligible individual to that individual’s HSA must be less than or equal to the IRA or Roth IRA account owner’s maximum annual HSA contribution. The maximum annual HSA contribution is based on (1) the individual’s age as of the end of the taxable year and (2) the individual’s type of high deductible health plan (HDHP) coverage (self-only or family HDHP coverage) at the time of the distribution. For example, in 2008, an IRA owner who is an eligible individual with family HDHP coverage at the time of the distribution and who is age 55 or over by the end of the year is allowed a qualified HSA funding distribution of $5,800, plus the $900 catch-up contribution. An IRA or Roth IRA owner who is an eligible individual with self-only HDHP coverage, and who is under age 55 as of the end of the taxable year, is allowed a qualified HSA funding distribution of $2,900 for 2008.

One-time qualified HSA funding distribution

Generally, only one qualified HSA funding distribution is allowed during the lifetime of an individual. If, however, the distribution occurs when the individual has self-only HDHP coverage, and later in the same taxable year the individual has family HDHP coverage, the individual is allowed a second qualified HSA funding distribution in that taxable year. Both distributions count against the individual’s maximum HSA contribution for that taxable year. The distributions must be from an IRA or Roth IRA to an HSA owned by the individual who owns the IRA or Roth IRA or, in the case of an inherited IRA, for whom the IRA or Roth IRA is maintained (i.e., a qualified HSA funding distribution cannot be made to an HSA owned by any other person, including the individual’s spouse). IRA or Roth IRA owners are not required to make the maximum qualified HSA funding distribution or to make any qualified HSA funding distribution.

If an individual owns two or more IRAs, and wants to use amounts in multiple IRAs to make a qualified HSA funding distribution, the individual must first make an IRA-to-IRA transfer of the amounts to be distributed into a single IRA, and then make the one-time qualified HSA funding distribution from that IRA.

No deemed distribution date

A qualified HSA funding distribution relates to the taxable year in which the distribution is actually made. The rules in § 223(d)(4)(B) and § 219(f)(3) (contributions made before the deadline for filing the individual’s federal income tax return are deemed to be made on the last day of the preceding taxable year) do not apply to qualified HSA funding distributions.

IRC §408(d)(9)(C):

(9) Distribution for health savings account funding.

…

(C) Limitations.

(i) Maximum dollar limitation. The amount excluded from gross income by subparagraph (A) shall not exceed the excess of—

(I) the annual limitation under section 223(b) computed on the basis of the type of coverage under the high deductible health plan covering the individual at the time of the qualified HSA funding distribution, over

(II) in the case of a distribution described in clause (ii)(II) , the amount of the earlier qualified HSA funding distribution.

(ii) One-time transfer.

(I) In general. Except as provided in sub clause (II) , an individual may make an election under subparagraph (A) only for one qualified HSA funding distribution during the lifetime of the individual. Such an election, once made, shall be irrevocable.

(II) Conversion from self-only to family coverage. If a qualified HSA funding distribution is made during a month in a taxable year during which an individual has self-only coverage under a high deductible health plan as of the first day of the month, the individual may elect to make an additional qualified HSA funding distribution during a subsequent month in such taxable year during which the individual has family coverage under a high deductible health plan as of the first day of the subsequent month.

IRS Notice 2007-22:

http://www.irs.gov/pub/irs-drop/n-07-22.pdf

EFFECTIVE DATE

The provision in the Act allowing qualified HSA distributions from health FSAs and HRAs is effective on or after December 20, 2006, and before January 1, 2012.

Newfront Go All the Way With HSA Guide

Brian Gilmore

Lead Benefits Counsel, VP, Newfront

Brian Gilmore is the Lead Benefits Counsel at Newfront. He assists clients on a wide variety of employee benefits compliance issues. The primary areas of his practice include ERISA, ACA, COBRA, HIPAA, Section 125 Cafeteria Plans, and 401(k) plans. Brian also presents regularly at trade events and in webinars on current hot topics in employee benefits law.

Connect on LinkedIn