Enrolling New Dependents and Changing Plan Options Under COBRA

By Brian Gilmore | Published September 20, 2019

**Question: **When can COBRA qualified beneficiaries enroll new dependents or change plan options?

**Short Answer: **COBRA qualified beneficiaries can make plan changes upon experiencing HIPAA special enrollment events, moving outside the plan’s regional service area, and during the plan’s open enrollment period.

General Rule: Same Coverage as in Effect Upon the Qualifying Event

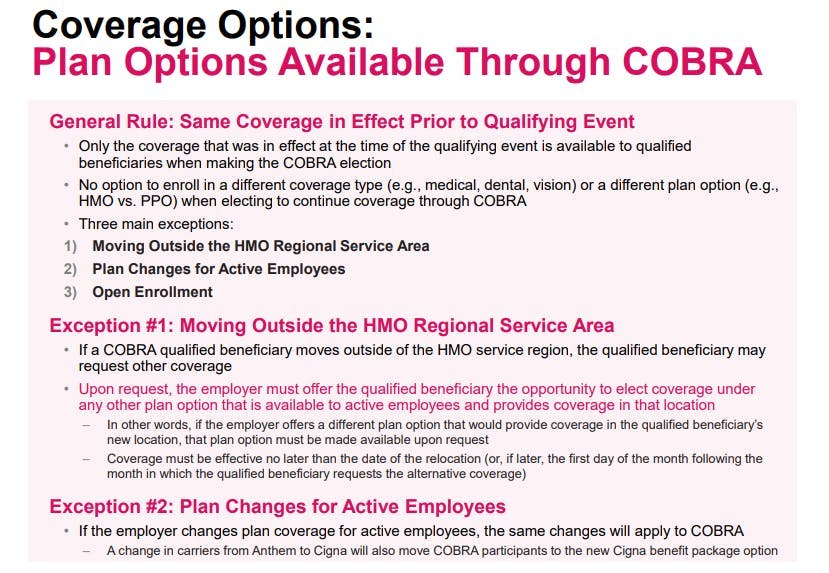

The general rule is that COBRA provides the same coverage to qualified beneficiaries that was in effect at the time of the qualifying event.

There are two main pieces to this general rule:

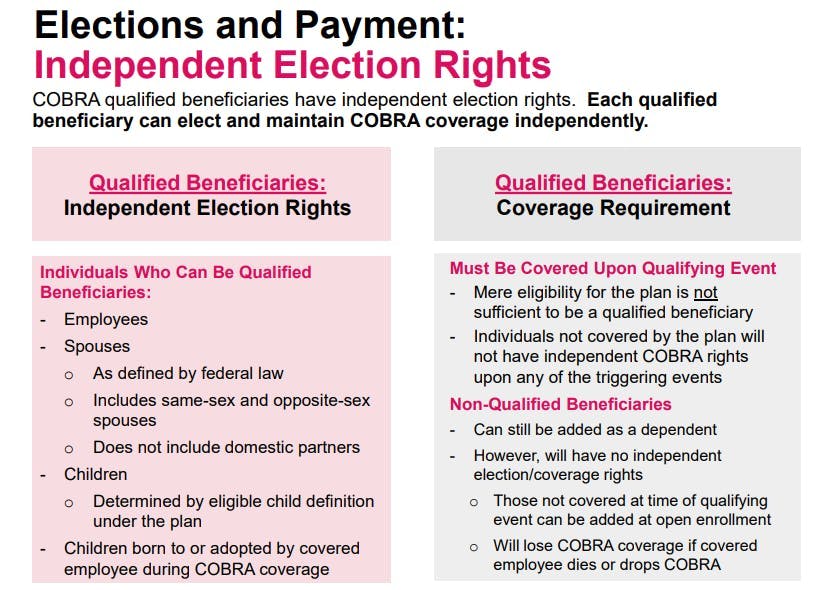

a. An individual must be covered under the group health plan—and experience a qualifying event while covered by the plan—to be eligible for COBRA coverage as a qualified beneficiary.

Individuals who are not covered by the group health plan do not experience a COBRA qualifying event and will not receive a COBRA election notice upon any of the triggering events (e.g., termination of employment or reduction of hours). Mere eligibility for the plan is not sufficient.

b. COBRA qualified beneficiaries have no option to enroll in a different coverage type (e.g., medical, dental, vision) or a different plan option (e.g., HMO vs. PPO) when making the election to continue coverage through COBRA.

For more details, see our previous post: Which Plan Options Must be Offered Under COBRA.

Three Exceptions to the General Rule

The following exceptions permit COBRA qualified beneficiaries to add dependents or change plan options:

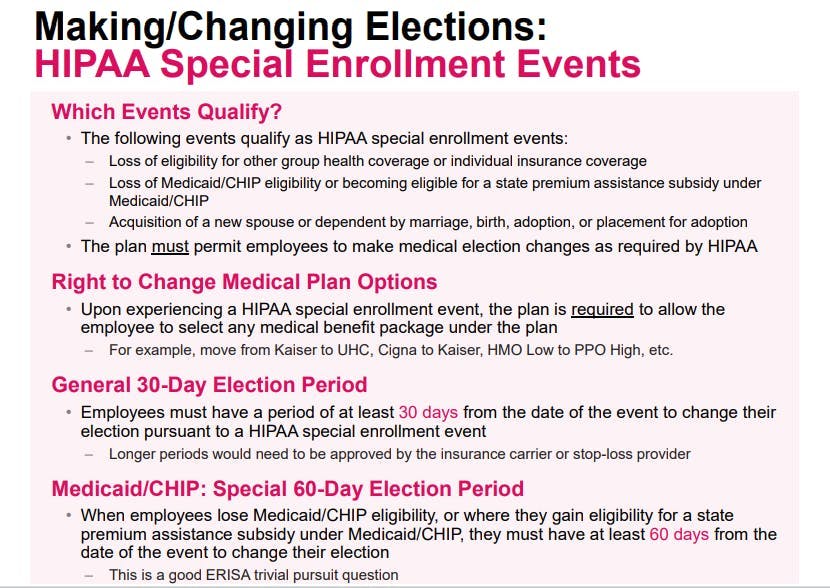

1, HIPAA Special Enrollment Events

The HIPAA special enrollment events apply to COBRA qualified beneficiaries for purposes of medical coverage. Qualified beneficiaries can enroll dependents upon experiencing a HIPAA special enrollment event.

However, the newly enrolled dependents generally are not qualified beneficiaries, and therefore can be covered through COBRA only as a dependent of a qualified beneficiary. In other words, the newly enrolled dependents do not have independent COBRA election or coverage rights.

The one exception is that a child who is born to or placed for adoption with a covered employee during a period of COBRA continuation coverage is a qualified beneficiary.

The following events qualify as HIPAA special enrollment events:

Loss of eligibility for group health coverage or individual health insurance coverage;

Loss of Medicaid/CHIP eligibility or becoming eligible for a state premium assistance subsidy under Medicaid/CHIP; and

Acquisition of a new spouse or dependent by marriage, birth, adoption, or placement for adoption.

The HIPAA special enrollment events are also marked in bold in the Newfront Section 125 Permitted Election Change Event Chart.

For more details, see our previous post: HIPAA Special Enrollment Events.

2. Moving Outside the HMO Regional Service Area

If a COBRA qualified beneficiary moves outside the HMO service region, and the qualified beneficiary requests other coverage, the employer must offer the qualified beneficiary the opportunity to elect coverage under any other plan option that is available to active employees and provides coverage in the qualified beneficiary’s new location.

In other words, if the employer offers a different plan option that would provide coverage in the qualified beneficiary’s new location, that plan option must be made available to the qualified beneficiary upon relocating (or, if later, the first day of the month following the month in which the qualified beneficiary requests the alternative coverage).

For more details, see our previous post: Which Plan Options Must be Offered Under COBRA.

3. Open Enrollment

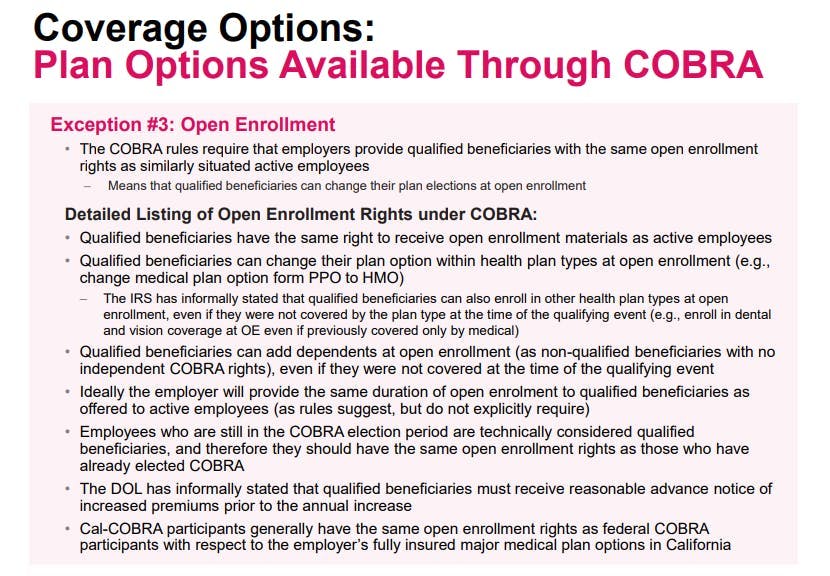

The COBRA rules require that employers provide qualified beneficiaries with the same open enrollment rights as similarly situated active employees.

This means that qualified beneficiaries can change their health plan elections at open enrollment. Qualified beneficiaries can also enroll dependents as non-qualified beneficiaries at open enrollment, even if those dependents were not covered at the time of the qualifying event.

For more details, see our previous post: Open Enrollment Rights for COBRA Participants

Regulations

Treas. Reg. §54.4980B-3:

Q-1. Who is a qualified beneficiary?

**A-1. **(a)(1) Except as set forth in paragraphs (c) through (f) of this Q&A-1, a qualified beneficiary is—

(i) Any individual who, on the day before a qualifying event, is covered under a group health plan by virtue of being on that day either a covered employee, the spouse of a covered employee, or a dependent child of the covered employee; or

(ii) Any child who is born to or placed for adoption with a covered employee during a period of COBRA continuation coverage.

…

(3) In general, an individual (other than a child who is born to or placed for adoption with a covered employee during a period of COBRA continuation coverage) who is not covered under a plan on the day before the qualifying event cannot be a qualified beneficiary with respect to that qualifying event, and the reason for the individual’s lack of actual coverage (such as the individual’s having declined participation in the plan or failed to satisfy the plan’s conditions for participation) is not relevant for this purpose. However, if the individual is denied or not offered coverage under a plan under circumstances in which the denial or failure to offer constitutes a violation of applicable law (such as the Americans with Disabilities Act, 42 U.S.C. 12101-12213, the special enrollment rules of section 9801, or the requirements of section 9802 prohibiting discrimination in eligibility to enroll in a group health plan based on health status), then, for purposes of §§54.4980B-1 through 54.4980B-10, the individual will be considered to have had the coverage that was wrongfully denied or not offered.

…

**Q-. 2. **Who is an employee and who is a covered employee?

**A-2. **

..

(b) For purposes of §§54.4980B-1 through 54.4980B-10, a covered employee is any individual who is (or was) provided coverage under a group health plan (other than a plan that is excepted from COBRA on the date of the qualifying event; see Q&A-4 of §54.4980B-2) by virtue of being or having been an employee. For example, a retiree or former employee who is covered by a group health plan is a covered employee if the coverage results in whole or in part from her or his previous employment. An employee (or former employee) who is merely eligible for coverage under a group health plan is generally not a covered employee if the employee (or former employee) is not actually covered under the plan. In general, the reason for the employee’s (or former employee’s) lack of actual coverage (such as having declined participation in the plan or having failed to satisfy the plan’s conditions for participation) is not relevant for this purpose. However, if the employee (or former employee) is denied or not offered coverage under circumstances in which the denial or failure to offer constitutes a violation of applicable law (such as the Americans with Disabilities Act, 42 U.S.C. 12101 through 12213, the special enrollment rules of section 9801, or the requirements of section 9802 prohibiting discrimination in eligibility to enroll in a group health plan based on health status), then, for purposes of §§54.4980B-1 through 54.4980B-10, the employee (or former employee) will be considered to have had the coverage that was wrongfully denied or not offered.

Treas. Reg. §54.4980B-4, Q/A-4:

**Q-. 4. **Can a qualified beneficiary who elects COBRA continuation coverage ever change from the coverage received by that individual immediately before the qualifying event?

**A-4. **(a) In general, a qualified beneficiary need only be given an opportunity to continue the coverage that she or he was receiving immediately before the qualifying event. This is true regardless of whether the coverage received by the qualified beneficiary before the qualifying event ceases to be of value to the qualified beneficiary, such as in the case of a qualified beneficiary covered under a region-specific health maintenance organization (HMO) who leaves the HMO’s service region. The only situations in which a qualified beneficiary must be allowed to change from the coverage received immediately before the qualifying event are as set forth in paragraphs (b) and (c) of this Q&A-4 and in Q&A-1 of this section (regarding changes to or elimination of the coverage provided to similarly situated non COBRA beneficiaries).

(b) If a qualified beneficiary participates in a region-specific benefit package (such as an HMO or an on-site clinic) that will not service her or his health needs in the area to which she or he is relocating (regardless of the reason for the relocation), the qualified beneficiary must be given, within a reasonable period after requesting other coverage, an opportunity to elect alternative coverage that the employer or employee organization makes available to active employees. If the employer or employee organization makes group health plan coverage available to similarly situated non COBRA beneficiaries that can be extended in the area to which the qualified beneficiary is relocating, then that coverage is the alternative coverage that must be made available to the relocating qualified beneficiary. If the employer or employee organization does not make group health plan coverage available to similarly situated non COBRA beneficiaries that can be extended in the area to which the qualified beneficiary is relocating but makes coverage available to other employees that can be extended in that area, then the coverage made available to those other employees must be made available to the relocating qualified beneficiary. The effective date of the alternative coverage must be not later than the date of the qualified beneficiary’s relocation, or, if later, the first day of the month following the month in which the qualified beneficiary requests the alternative coverage. However, the employer or employee organization is not required to make any other coverage available to the relocating qualified beneficiary if the only coverage the employer or employee organization makes available to active employees is not available in the area to which the qualified beneficiary relocates (because all such coverage is region-specific and does not service individuals in that area).

(c) If an employer or employee organization makes an open enrollment period available to similarly situated active employees with respect to whom a qualifying event has not occurred, the same open enrollment period rights must be made available to each qualified beneficiary receiving COBRA continuation coverage. An open enrollment period means a period during which an employee covered under a plan can choose to be covered under another group health plan or under another benefit package within the same plan, or to add or eliminate coverage of family members.

Treas. Reg. §54.4980B-5, Q/A-5(a):

**Q-. 5. **Aside from open enrollment periods, can a qualified beneficiary who has elected COBRA continuation coverage choose to cover individuals (such as newborn children, adopted children, or new spouses) who join the qualified beneficiary’s family on or after the date of the qualifying event?

**A-5. **(a) Yes. Under section 9801, employees eligible to participate in a group health plan (whether or not participating), as well as former employees participating in a plan (referred to in those rules as participants), are entitled to special enrollment rights for certain family members upon the loss of other group health plan coverage or upon the acquisition by the employee or participant of a new spouse or of a new dependent through birth, adoption, or placement for adoption, if certain requirements are satisfied. Employees not participating in the plan also can obtain rights for self-enrollment under those rules. Once a qualified beneficiary is receiving COBRA continuation coverage (that is, has timely elected and made timely payment for COBRA continuation coverage), the qualified beneficiary has the same right to enroll family members under those special enrollment rules as if the qualified beneficiary were an employee or participant within the meaning of those rules. However, neither a qualified beneficiary who is not receiving COBRA continuation coverage nor a former qualified beneficiary has any special enrollment rights under those rules.

Brian Gilmore

Lead Benefits Counsel, VP, Newfront

Brian Gilmore is the Lead Benefits Counsel at Newfront. He assists clients on a wide variety of employee benefits compliance issues. The primary areas of his practice include ERISA, ACA, COBRA, HIPAA, Section 125 Cafeteria Plans, and 401(k) plans. Brian also presents regularly at trade events and in webinars on current hot topics in employee benefits law.

Connect on LinkedIn