HSA Catch-Up Contributions

By Brian Gilmore | Published January 10, 2020

Question: How do the HSA catch-up contribution rules work, and particularly how do they apply for married individuals?

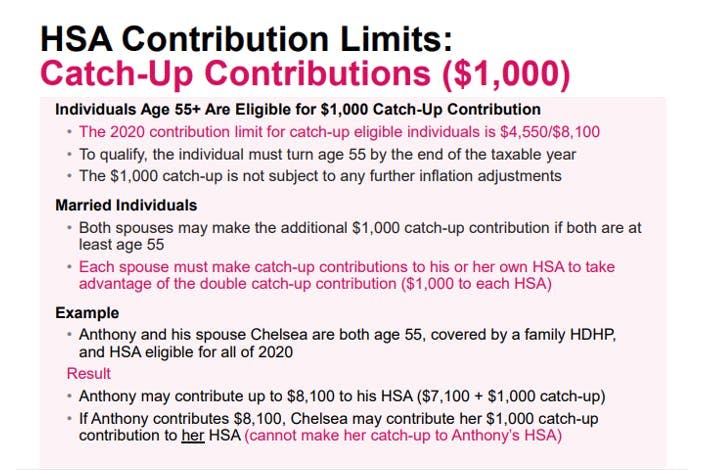

Short Answer: If both spouses are HSA eligible and at least age 55, each spouse may make a $1,000 catch-up contribution to their own HSA.

Catch-Up Contributions: General Rule

Individuals who are HSA eligible and age 55+ may contribute an additional $1,000 catch-up contribution to their HSA each calendar year. Individuals must turn age 55 by the end of the calendar year to qualify for the catch-up contribution.

Unlike the standard statutory annual limits that increase each year, this $1,000 annual catch-up contribution limit has been fixed by law at $1,000 since 2009 and will not adjust further for inflation.

Catch-Up Contributions: Becoming HSA Eligible or Losing HSA Eligibility Mid-Year

The catch-up contribution (as with the standard statutory limit) is subject to a prorated limit based on the number of calendar months in which the individual was HSA eligible.

Therefore, unless the last-month rule applies, an individual must be HSA eligible for all 12 months of the calendar year to contribute the full $1,000 catch-up contribution. For more details on the last-month rule (which applies identically to catch-up contributions), see our previous post: The HSA Last-Month Rule.

The calculation of an individual’s catch-up contribution is as follows:

Take the highest potential catch-up contribution amount available of $1,000

Divide that $1,000 amount by 12 months

Multiply the result by the number of months of HSA eligibility (determined as of the first day of each calendar month).

Example 1:

Anthony begins the year at age 65 in his employer’s HDHP with no disqualifying coverage.

Anthony enrolls in Medicare effective July 1, 2020, which causes him to lose HSA eligibility as of July.

Result 1:

Anthony’s catch-up contribution limit is 1,000 / 12 x 6 = $500.

For more details on how Medicare interacts with HSAs, see our previous post: How Medicare Affects HSA Eligibility.

Standard Statutory HSA Contribution Limits for Married Individuals

If both spouses are enrolled in employee-only HDHP coverage, the standard individual HSA contribution limit applies to each spouse.

If one or both spouses are enrolled in family HDHP coverage, the combined HSA contribution limit for both spouses is the family HSA contribution limit.

For full details (including lots of examples to clarify), see our previous post: HSA Contribution Limits for Spouses.

Catch-Up Contributions: Married Individuals

Both spouses may make the additional $1,000 catch-up contribution if they are both HSA-eligible and are both age 55+ by the end of the calendar year.

Although the special HSA contribution rules for married individuals permit one spouse to contribute up the standard statutory family contribution limit in his or her HSA, the catch-up contribution rules are designed differently. The catch-up contribution rules require each spouse to make the catch-up contribution to his or her own HSA to take advantage of the double catch-up contribution.

In other words, each spouse would have to contribute $1,000 to their own HSA to take advantage of the catch-up contribution for both HSA-eligible and catch-up-eligible spouses. One spouse cannot contribute a $2,000 catch-up amount (or any more than $1,000) to his or her own HSA for this purpose.

Therefore, in a married relationship where only one spouse has established an HSA—which is common due to the special HSA contribution rules for married individuals—the other spouse would need to establish an HSA just to fund the $1,000 catch-up contribution. That is the only way to take advantage of the catch-up contribution available to both spouses.

Example 2:

Anthony and his spouse Chelsea are both age 55+.

Both Anthony and Chelsea are covered by a family HDHP through Anthony’s employer, and both are HSA-eligible for all of 2020.

_The couple wants to take advantage of the maximum standard statutory and catch-up HSA contribution amounts available for 2020. _

Result 2:

Anthony may contribute up to $8,100 to his HSA ($7,100 family contribution limit + $1,000 catch-up contribution).

To take advantage of her catch-up contribution, Chelsea must establish her own HSA and contribute the $1,000 catch-up contribution to her HSA.

The catch-up contribution available to Chelsea cannot be made to Anthony’s HSA (i.e., Anthony cannot make a $2,000 catch-up contribution to his HSA).

For more details on everything HSA, see our Newfront Go All the Way With HSA Guide.

Regulations

IRC §223(b)(3):

(3) Additional contributions for individuals 55 or older.

(A) In general. In the case of an individual who has attained age 55 before the close of the taxable year, the applicable limitation under subparagraphs (A) and (B) of paragraph (2) shall be increased by the additional contribution amount.

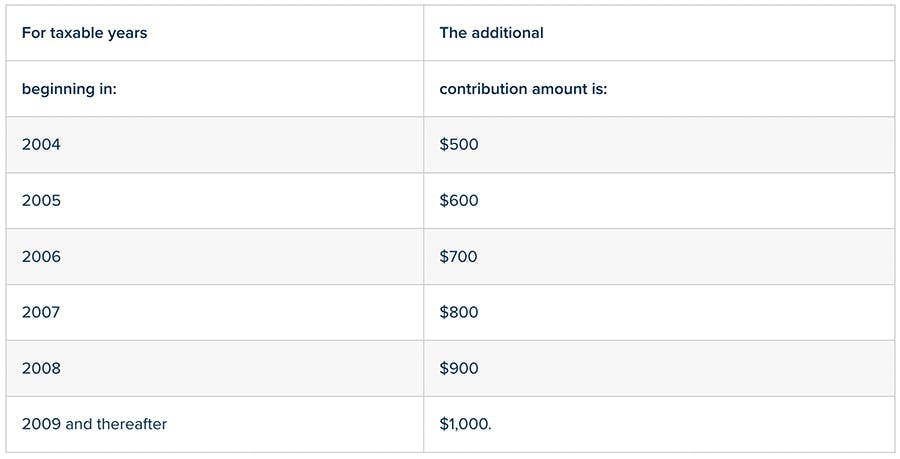

(B) Additional contribution amount. For purposes of this section, the additional contribution amount is the amount determined in accordance with the following table:

IRS Notice 2008-59:

https://www.irs.gov/pub/irs-drop/n-08-59.pdf

Q-22. If a husband and wife are each eligible to make catch-up contributions under § 223(b)(3), must each spouse contribute their catch-up contributions to their own HSA?

A-22. Yes. An individual who is eligible to make catch-up contributions may only make such contributions to his or her own HSA. See also Notice 2004-50, Q&A-32. If both spouses are eligible for the catch-up contribution, each spouse must make catch-up contributions to his or her own HSA.

IRS Publication 969:

https://www.irs.gov/pub/irs-pdf/p969.pdf

Additional contribution.

If you are an eligible individual who is age 55 or older at the end of your tax year, your contribution limit is increased by $1,000. For example, if you have self-only coverage, you can contribute up to $4,450 (the contribution limit for self-only coverage ($3,450) plus the additional contribution of $1,000).

Newfront Go All the Way With HSA Guide

Brian Gilmore

Lead Benefits Counsel, VP, Newfront

Brian Gilmore is the Lead Benefits Counsel at Newfront. He assists clients on a wide variety of employee benefits compliance issues. The primary areas of his practice include ERISA, ACA, COBRA, HIPAA, Section 125 Cafeteria Plans, and 401(k) plans. Brian also presents regularly at trade events and in webinars on current hot topics in employee benefits law.

Connect on LinkedIn