HSA Contribution Election Changes

By Brian Gilmore | Published February 15, 2019

Question: When can employees change their HSA pre-tax contribution elections?

Compliance Team Response:

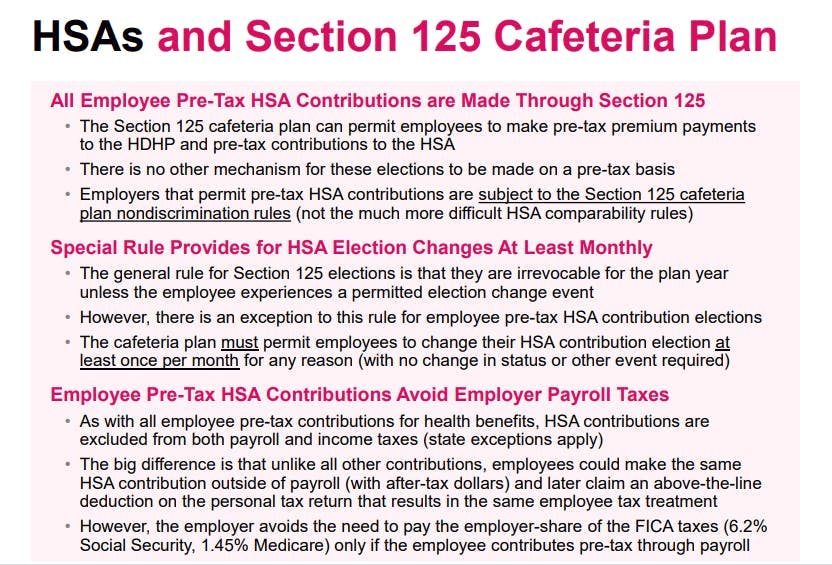

HSA Contributions Governed by Cafeteria Plan Rules

The Section 125 cafeteria plan is the exclusive mechanism for employees to make pre-tax contributions to an HSA through payroll. Therefore, all employee pre-tax HSA contributions are governed by the cafeteria plan rules.

Employers Must Permit HSA Election Changes at Least Monthly

The Section 125 cafeteria rules provide that employers must permit employees to change their HSA contribution election at least once per month.

The cafeteria plan may permit employees to change their HSA elections more frequently (e.g., once per pay period), but at a minimum it must allow employees to change their elections at least monthly. This monthly election change option for employee pre-tax HSA contributions is designed to align with the month-by-month HSA eligibility rules (i.e., HSA eligibility to make or receive HSA contributions is determined as of the first day of each calendar month).

Employees May Change HSA Contribution Election for Any Reason

Furthermore, employees may change their HSA contribution election for any reason. In other words, employees do not need to experience a permitted election change event to change their HSA salary reduction contribution elections.

Exception from Section 125 Irrevocable Election Rule

Note that this special HSA election change rule is a limited exception from the general Section 125 rule requiring that cafeteria plan elections for pre-tax contributions be irrevocable for the plan year unless the employee experiences a permitted election change event. For an overview of the mid-year election change rules that otherwise apply for all other cafeteria plan elections, see the Newfront Section 125 Permitted Election Change Event Chart.

Regulations

Prop. Treas. Reg. §1.125-2(c)(1)(ii):

(c) Election rules for salary reduction contributions to HSAs.

(1) Prospective elections and changes in salary reduction elections allowed. Contributions may be made to an HSA through a cafeteria plan. A cafeteria plan offering HSA contributions through salary reduction may permit employees to make prospective salary reduction elections or change or revoke salary reduction elections for HSA contributions (for example, to increase or decrease salary reduction elections for HSA contributions) at any time during the plan year, effective before salary becomes currently available. If a cafeteria plan offers HSA contributions as a qualified benefit, the plan must—

(i) Specifically describe the HSA contribution benefit;

(ii) Allow a participant to prospectively change his or her salary reduction election for HSA contributions on a monthly basis (or more frequently); and (

iii) Allow a participant who becomes ineligible to make HSA contributions to prospectively revoke his or her salary reduction election for HSA contributions.

(2) Example. The following example illustrates the rules in this paragraph (c):

_Example. _Prospective HSA salary reduction elections.

(i) A cafeteria plan with a calendar plan year allows employees to make salary reduction elections for HSA contributions through the plan. The cafeteria plan permits employees to prospectively make, change or revoke salary contribution elections for HSA contributions, limited to one election, change or revocation per month.

(ii) Employee M participates in the cafeteria plan. Before salary becomes currently available to M, M makes the following elections. On January 2, 2009, M elects to contribute $100 for each pay period to an HSA, effective January 3, 2009. On March 15, 2009, M elects to reduce the HSA contribution to $35 per pay period, effective April 1, 2009. On May 1, 2009, M elects to discontinue all HSA contributions, effective May 15, 2009. The cafeteria plan implements all of Employee M’s elections,

(iii) The cafeteria plan’s operation is consistent with the section 125 election, change and revocation rules for HSA contributions.

Q-58. Do the section 125 change in status rules apply to elections of HSA contributions through a cafeteria plan?

A-58. A cafeteria plan may permit an employee to revoke an election during a period of coverage with respect to a qualified benefit and make a new election for the remaining portion of the period only as provided in Treas. Reg. § 1.125-4. B_ecause the eligibility requirements and contribution limits for HSAs are determined on a month-by-month basis, rather than on an annual basis, an employee who elects to make HSA contributions under a cafeteria plan may start or stop the election or increase or decrease the election at any time as long as the change is effective prospectively (i.e., after the request for the change is received)._ If an employer places additional restrictions on the election of HSA contributions under a cafeteria plan, the same restrictions must apply to all employees.

Newfront Guide: Go All the Way With HSA

Newfront Section 125 Permitted Election Change Event Chart

Brian Gilmore

Lead Benefits Counsel, VP, Newfront

Brian Gilmore is the Lead Benefits Counsel at Newfront. He assists clients on a wide variety of employee benefits compliance issues. The primary areas of his practice include ERISA, ACA, COBRA, HIPAA, Section 125 Cafeteria Plans, and 401(k) plans. Brian also presents regularly at trade events and in webinars on current hot topics in employee benefits law.

Connect on LinkedIn