IRS Expands Definition of Preventive Care for HDHPs

By Brian Gilmore | Published July 24, 2019

The IRS has issued new guidance in Notice 2019-45 expanding the definition of “preventive care” for high deductible health plan (HDHP) purposes.

The new expanded list adds certain medical services and items, including prescription drugs, related to preventing exacerbation of a chronic condition (or the development of an associated secondary condition).

The guidance comes in response to President Trump’s June 2019 Executive Order directing the IRS to issue such guidance. Furthermore, the Notice states that the Treasury Department and the IRS are aware that cost barriers for care related to chronic conditions can result in some individuals failing to seek or utilize effective and necessary care that would prevent exacerbation of the chronic condition.

HDHP Preventive Services

Individuals must be covered by a HDHP (and have no disqualifying coverage) to be eligible to make or receive HSA contributions.

One of the key requirements for all HDHP coverage is that the plan impose at least the minimum statutory deductible prior to paying for covered services. The current 2019 HDHP minimum deductible is $1,350 for single coverage, and $2,700 for family coverage. The 2020 HDHP minimum deductibles will increase slightly to $1,400 for single coverage, and $2,800 for family coverage.

See our recent Alert for more details: IRS Releases 2020 Inflation Adjusted Amounts for HSAs

The main exception to this minimum deductible requirement is the ability for HDHPs to provide first-dollar coverage (i.e., not subject to the deductible) for preventive care. In other words, all services other than preventive care must be subject to the annual deductible before the plan pays for covered services.

“Preventive care” for HDHP purposes generally includes:

– Periodic health evaluations, including annual physicals,

– Routine prenatal and well-child care

– Child and adult immunizations

– Tobacco cessation programs

– Obesity weight-loss programs

– Screening services (listed in IRS Notice 2004-23)

– The ACA preventive services that are required to be provided without cost-sharing for non-grandfathered health plans

– NEW: Medical services and items to prevent exacerbation of a chronic condition

The Notice states that the IRS will periodically review the list every five to ten years to determine whether additional preventive services should be included (or any should be removed).

Note: A transition period is currently in effect until 2020 to permit HDHPs to provide first-dollar coverage for male contraceptive/sterilization benefits. See our previous notice for more details: HSA Eligibility and New State Male Contraception Mandates

The New Chronic Condition Preventive Services

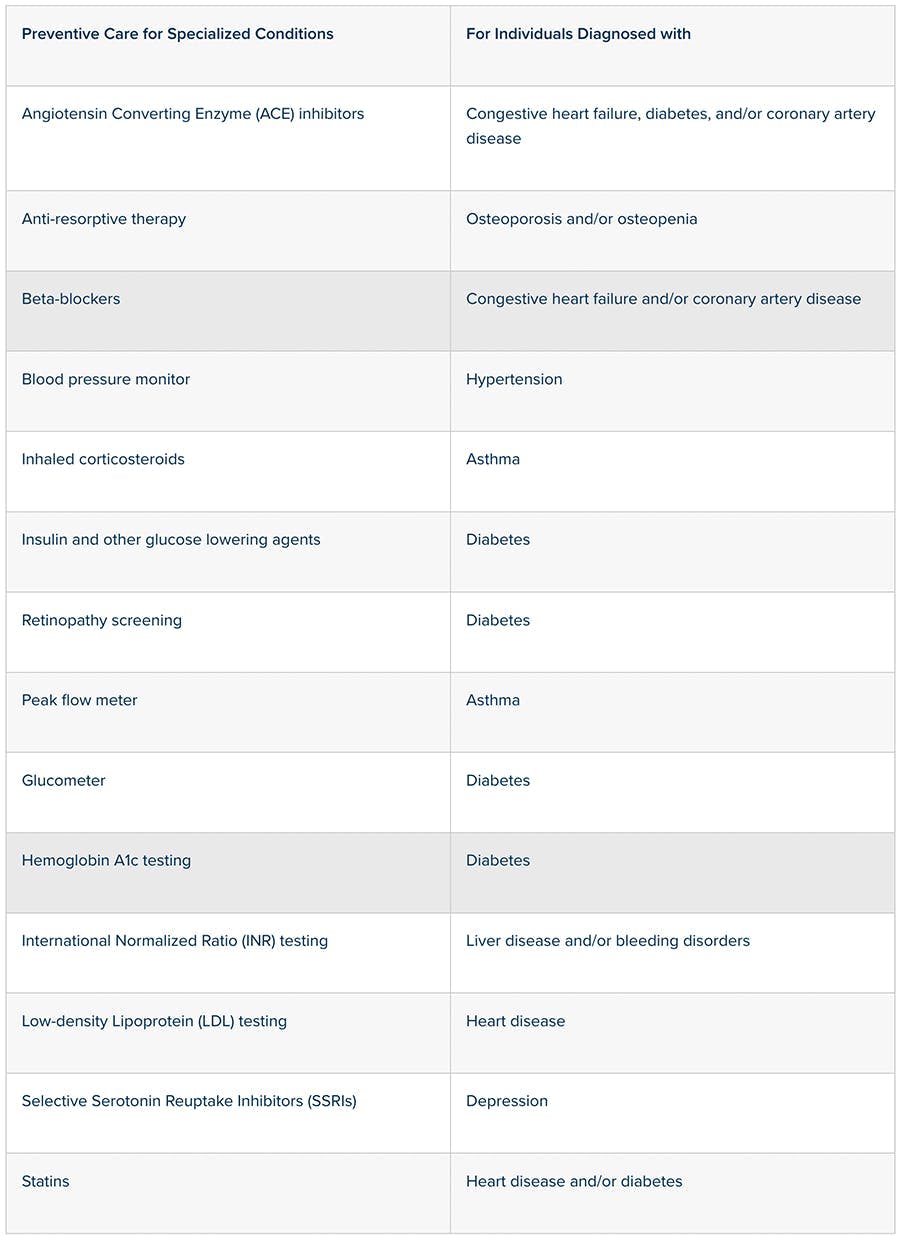

Effective immediately, HDHPs may provide first-dollar coverage for the following medical items and services to prevent exacerbation of a chronic condition:

Employers sponsoring HDHPs (and the insurance carriers and TPAs that generally drive plan design) will likely consider including these additional forms for first-dollar preventive care benefits for the next plan year.

For more details on HDHPs and HSAs generally, see our Office Hours webinar: Go All the Way With HSA: Everything HDHP/HSA You Need to Know.

What About the Health FSA $500 Carryover?

The same President Trump Executive Order that prompted this new HDHP guidance also directs the Department of the Treasury to issue guidance within 180 days that increases the $500 health FSA carryover limit. We will keep you posted on any new developments in that area.

Brian Gilmore

Lead Benefits Counsel, VP, Newfront

Brian Gilmore is the Lead Benefits Counsel at Newfront. He assists clients on a wide variety of employee benefits compliance issues. The primary areas of his practice include ERISA, ACA, COBRA, HIPAA, Section 125 Cafeteria Plans, and 401(k) plans. Brian also presents regularly at trade events and in webinars on current hot topics in employee benefits law.

Connect on LinkedIn