IRS Releases 2020 Inflation Adjusted Amounts for HSAs

By Brian Gilmore | Published May 28, 2019

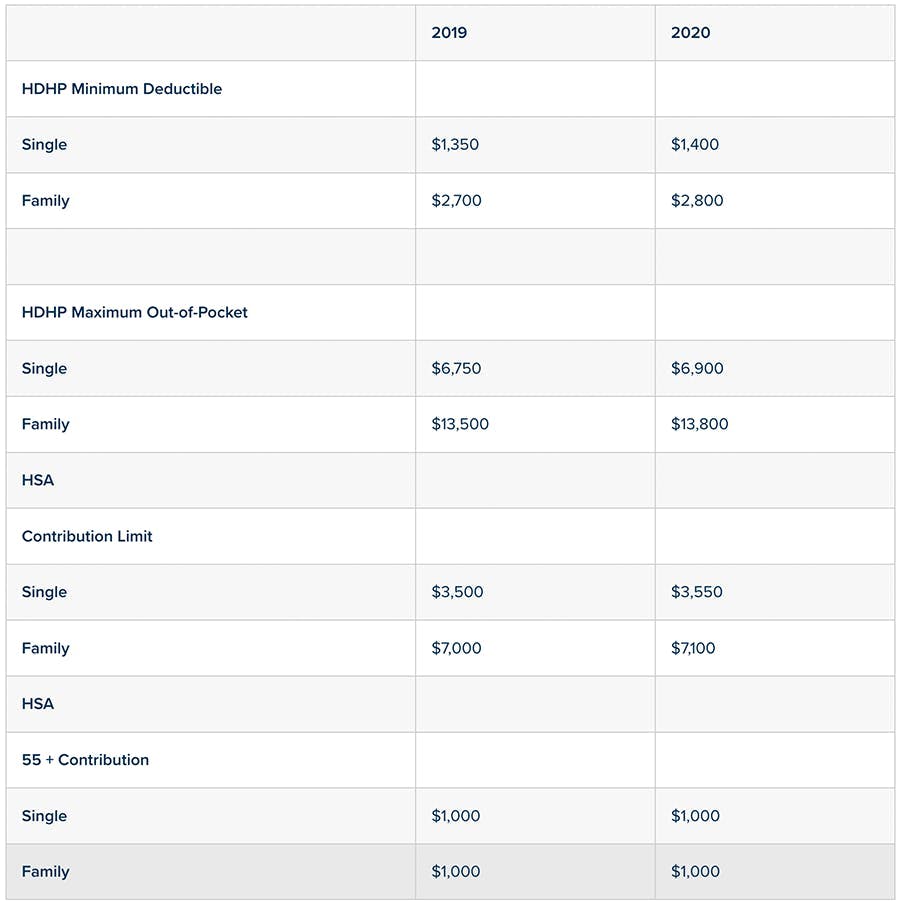

The IRS has released Revenue Procedure 2019-25 detailing the HSA contribution limit increases for 2020.

The 2020 HSA contribution limit for individual coverage will increase by $50 to $3,550.

The 2020 HSA contribution limit for family coverage (employee plus at least one dependent) will increase by $100 to $7,100.

The catch-up contribution limit of $1,000 is fixed by law and does not adjust for inflation.

The Revenue Procedure also includes the 2020 calendar year minimum deductible and out-of-pocket maximums allowed for a plan to qualify as a high deductible health plan (HDHP)—the required coverage for an individual to be eligible to make or receive HSA contributions.

The 2020 minimum deductible for individual coverage will increase by $50 to $1,400.

The 2020 minimum deductible for family coverage will increase by $100 to $2,800.

The 2020 maximum out-of-pocket limit for individual coverage will increase by $150 to $6,900.

The 2020 maximum out-of-pocket limit for family coverage will increase by $300 to $13,800.** **

For more details on everything HSA-related, see our recent Newfront Office Hours Webinar: Go All the Way With HSA.

Brian Gilmore

Lead Benefits Counsel, VP, Newfront

Brian Gilmore is the Lead Benefits Counsel at Newfront. He assists clients on a wide variety of employee benefits compliance issues. The primary areas of his practice include ERISA, ACA, COBRA, HIPAA, Section 125 Cafeteria Plans, and 401(k) plans. Brian also presents regularly at trade events and in webinars on current hot topics in employee benefits law.

Connect on LinkedIn