Mid-Year Enrollment of a Domestic Partner

By Brian Gilmore | Published January 18, 2019

Question: When should an employer permit an employee to enroll a domestic partner in the health plan mid-year?

Compliance Team Response:

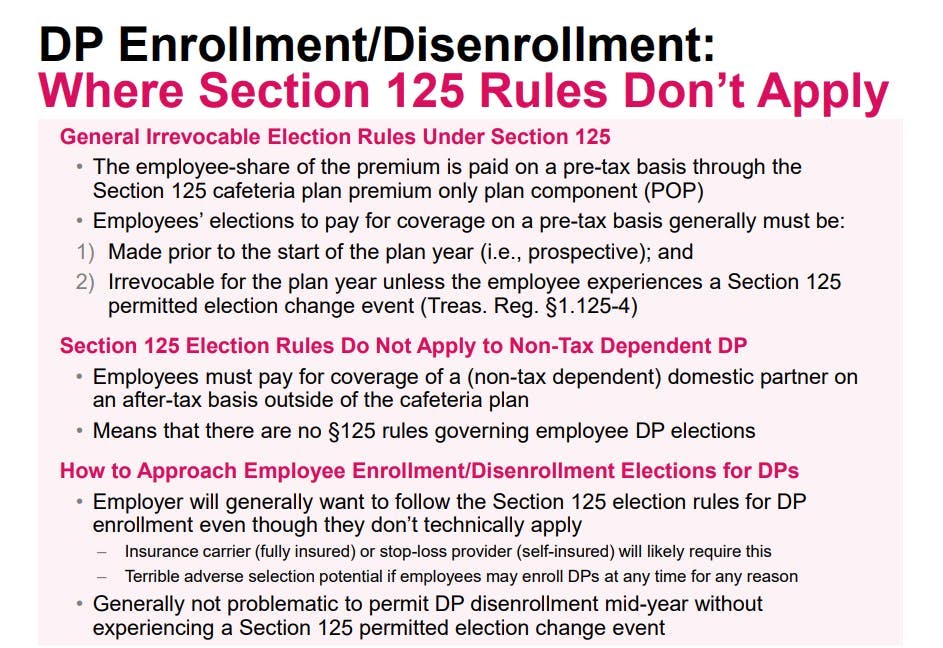

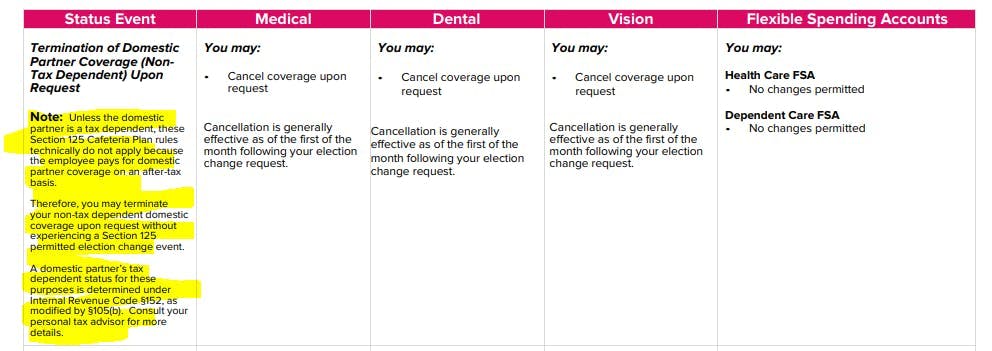

The Section 125 permitted election change event rules generally do not apply to domestic partner coverage because employees pay for such coverage on an after-tax basis (unless the domestic partner is the employee’s tax dependent, which is less common). That means there is no legal barrier to permitting an employee to add a domestic partner to coverage at any point in the year and for any reason.

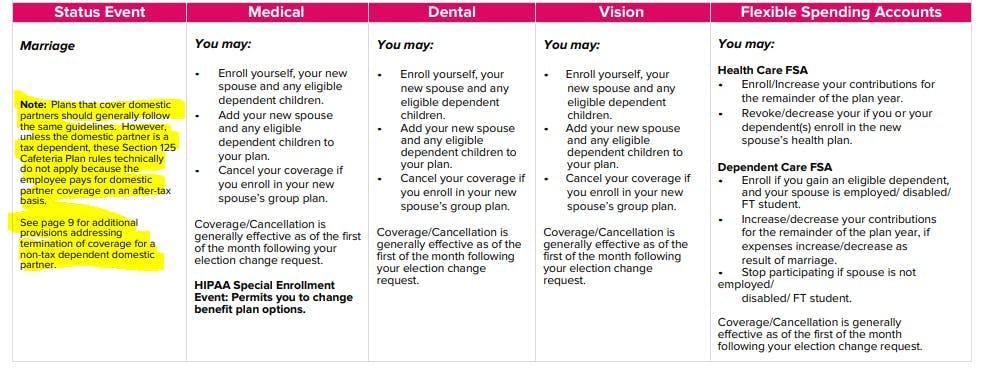

However, we recommend that employers still follow the Section 125 permitted election change event rules for adding a domestic partner mid-year. In other words, we recommend that the employer treat the domestic partner as if he or she is a spouse for purposes of determining when a mid-year enrollment is permitted.

There are three main reasons why we recommend this approach as best practice:

Adverse selection: Allowing employees to enroll a domestic partner at any point is a serious adverse selection issue. There would be little incentive for an employee to cover a domestic partner when healthy and not requiring medical treatment if the employee could add the domestic partner at any point and for any reason.

ERISA plan precedent: Employers that permit one employee to enroll a domestic partner mid-year without experiencing a permitted election change event would need to follow the same approach for all other employees with domestic partners. There could not be one-time exceptions limited to certain employees.

Insurance carriers: The insurance carriers (or stop-loss providers for a self-insured plan) generally will permit employees to enroll an eligible dependent mid-year only upon experiencing a Section 125 permitted election change event. Those carrier practices are somewhat murky where Section 125 does not apply, such as the case of non-tax dependent domestic partner. Nonetheless, permitting an employee to enroll a domestic partner mid-year outside of a permitted election change event would require carrier approval—and the carrier would likely be well within its right to deny the request under the terms of the policy and because of the obvious adverse selection red flags.

Therefore, we recommend treating a domestic partner in the same manner as a spouse where determining when the employee may enroll the domestic partner mid-year by following the same events that would apply to permit a spouse’s mid-year enrollment. For example, an employee should be permitted to add a domestic partner within 30 days of becoming a registered domestic partner or meeting the company’s definition of a domestic partner (if applicable).

Note that we generally see no issue with permitting an employee to remove a non-tax dependent partner from coverage at any point during the year because that does not raise the same concerns as a mid-year enrollment.

For more details:

Brian Gilmore

Lead Benefits Counsel, VP, Newfront

Brian Gilmore is the Lead Benefits Counsel at Newfront. He assists clients on a wide variety of employee benefits compliance issues. The primary areas of his practice include ERISA, ACA, COBRA, HIPAA, Section 125 Cafeteria Plans, and 401(k) plans. Brian also presents regularly at trade events and in webinars on current hot topics in employee benefits law.

Connect on LinkedIn