Prior-Year Employer HSA Contribution by Tax Deadline

By Brian Gilmore | Published April 13, 2018

Question: The employer missed making a HSA contribution in 2017. How can the employer make the contribution in 2018 without a) counting toward the 2018 contribution limit, or b) requiring any changes to the 2017 Form W-2?

Compliance Team Response:

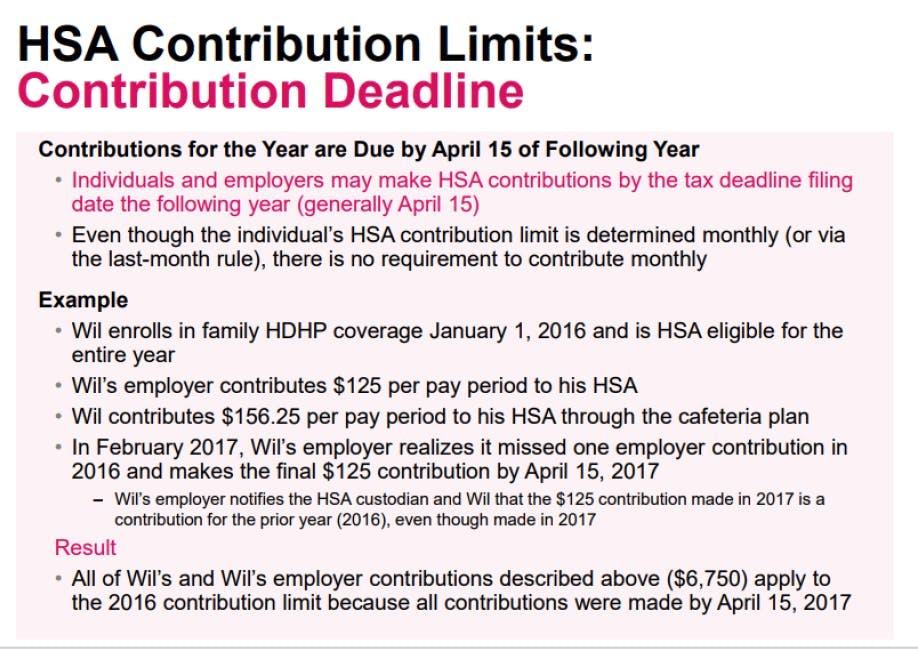

The HSA rules provide that employers can make a prior-year missed HSA contribution by the tax filing deadline. Those contributions will be reflected on the Form W-2 for the year in which they are made (not the year for which the contributions apply).

So for missed 2017 contributions, the employer can still make the contribution allocated to that year if done by the 2017 tax filing deadline of April 17, 2018. (April 15 is a Sunday and April 16 is Emancipation Day.)

There are two rules the employer need to be aware of:

1) The employer must notify both the employee and the HSA bank that the contributions are to be allocated to the prior year (2017); and2) The employer will report the prior-year (2017) contributions on the employee’s current year {2018) Form W-2 (even though they relate to 2017).

By following this process, the employer can both make a prior-year make up HSA contribution and avoid the need to correct the employee’s prior-year Form W-2.

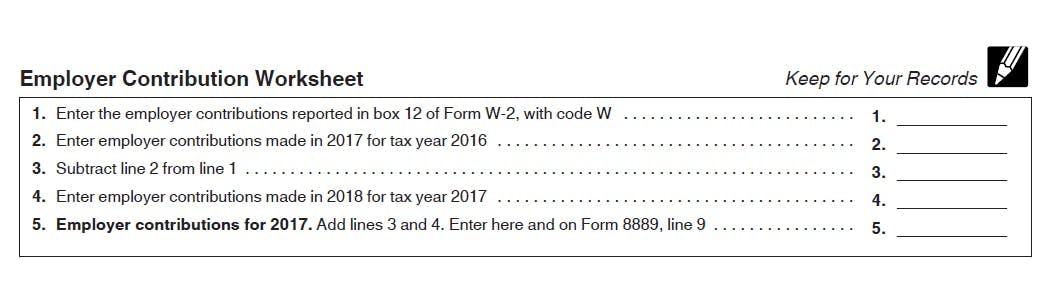

Although the current year Form W-2 (2018) may show contributions in excess of the statutory limit, the employee will subtract the prior-year (2017) make up contributions on the current year (2018} individual tax return when preparing the Form 8889 to reflect that the contributions allocated to the current year (2018} remained within the statutory limit.

Regulations:

IRS Notice 2008-59, Q/A-21:

https://www.irs.gov/irb/2008-29 IRB#NOT-2008-59

Q-21. May employer contributions to employees’ HSAs made between January 1 and the date for filing the employee’s return, without extensions, be allocated to the prior year?

A-21. Yes. For employer contributions (including salary reduction contributions) made between January 1 and the date for filing the employees’ federal income tax return without extension, the employer must notify the HSA trustee or custodian if the contributions relate to the prior year. The employer must also inform the employee of the designation. However, the contributions designated as made for the prior year are still reported in box 12 with code Won the employees’ Form W-2 for the year in which the contributions are actually made.

_**Example. **_In January 2009, Employer K contributes $500 to each employee’s HSA and notifies the HSA trustee (and provides a statement to the employees) that the contributions are for 2008. Subsequently, in 2009, Employer K contributes $250 to each employee’s HSA on March 31, June 30, September 30 and December 31. For each employee whose HSA received these contributions, Employer K reports a total contribution of $1,500 in box 12 with code Won the Form W-2 for 2009.

In completing the Form 8889 for 2008, to compute Employer K’s contributions, the employees add the $500 to any employer contributions reported in box 12, code Won the 2008 Form W-2. In completing the Form 8889 for 2009, the employees subtract the $500 from the box 12 code W amount on the 2009 Form W-2 and add to the remaining $1,000 any contributions for 2009 made by Employer K between January 1, 2009 and his or her filing date without extensions. See Instructions to Form 8889.

IRS Form 8889 Instructions:

https://www.irs.gov/pub/irs-pdf/i8889.pdf

Line 9

Employer Contributions

Employer contributions (including contributions through a cafeteria plan} include any amount an employer contributes to any HSA for you for 2017. These contributions should be shown in box 12 of Form W-2 with code W. If either of the following apply, complete the Employer Contribution Worksheet.

Employer contributions for 2016 are included in the amount reported in box 12 of Form W-2 with code W.

Employer contributions for 2017 are made in 2018.

Newfront Office Hours: Go All the Way with HSA Guide

Brian Gilmore

Lead Benefits Counsel, VP, Newfront

Brian Gilmore is the Lead Benefits Counsel at Newfront. He assists clients on a wide variety of employee benefits compliance issues. The primary areas of his practice include ERISA, ACA, COBRA, HIPAA, Section 125 Cafeteria Plans, and 401(k) plans. Brian also presents regularly at trade events and in webinars on current hot topics in employee benefits law.

Connect on LinkedIn