San Francisco Releases 2021 HCSO Expenditure Rates

By Karen Hooper | Published August 26, 2020

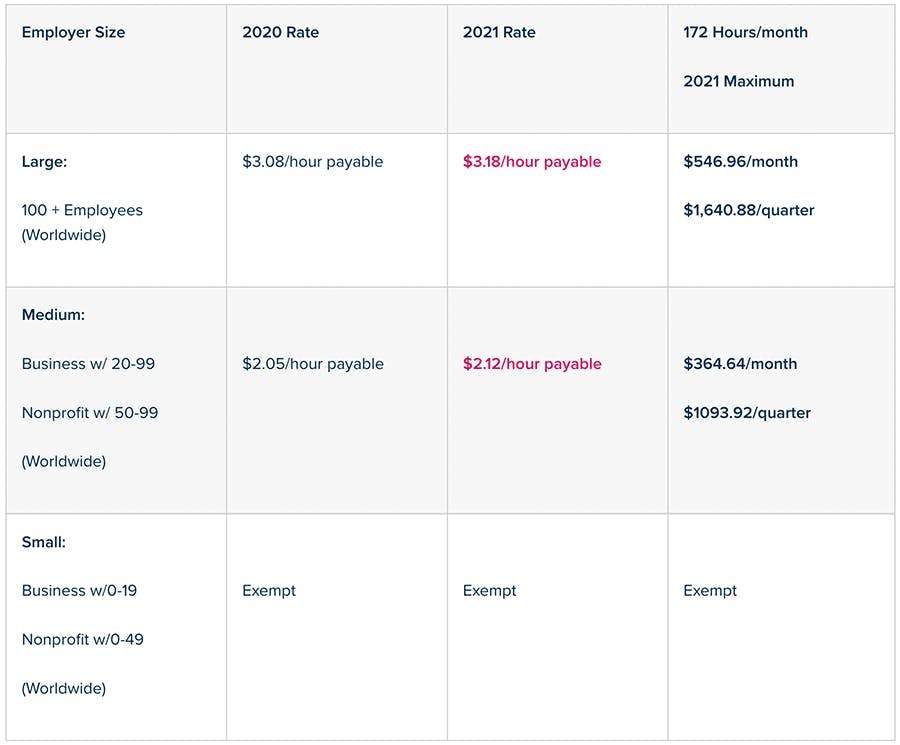

The San Francisco Office of Labor Standards Enforcement (OLSE) recently released the updated 2021 Health Care Security Ordinance (HCSO) required health expenditure rates.

What are the Employer Obligations?

Under the HCSO, Covered Employers with 20 or more employees (50 or more employees for nonprofits) in any quarter are required to make a minimum level of health care expenditures for that quarter for employees who:

Have been employed by the employer for at least 90 days,

Have performed at least 8 hours of work per week in San Francisco, and

Do not meet one of the five exemption criteria below.

What About Remote Employees?

With COVID-19, many employees are working from home. Employers will not be required to make expenditures for any employees who work outside of the geographic boundaries of San Francisco, but will be required to make expenditures for any remote employees who live in San Francisco.

SF HCSO Compliance in the Work-From-Home Era.

Other Employer Requirements

Even though the April 2020 reporting for 2019 HCSO expenditures was cancelled, employers are still required to make the 2020 quarterly expenditures.

In addition to making the required expenditures, Covered Employers are also required to:

Maintain records sufficient to establish compliance with the employer spending requirement

Post an HCSO Notice in all workplaces with covered employees

Submit the Annual Reporting form by April 30 each year (except this year).

Who is a Covered Employer?

You are a covered employer and are required to make health care expenditures if you met the following three conditions in 2020:

employed one or more workers within the geographic boundaries of the City and County of San Francisco;

were required to obtain a valid San Francisco business registration certificate pursuant to Article 12 of the Business and Tax Regulations Code,

employed 20 or more persons worldwide (for profit) a nonprofit organization that employed 50 or more persons worldwide.

Which Employees are Exempt or Excluded from Eligibility under the HCSO?

There are five categories of exempt employees:

Employees who sign a waiver form and voluntarily waive their right to have employers make Health Care Expenditures for their benefit.

Employees who qualify as Managers, supervisors or confidential employees AND earn more than the applicable salary exemption amount ($104,761 in 2020).

Employees who are covered by Medicare or Tricare.

Employees who are employed by a non-profit corporation as a trainee in a bona fide training program.

Employees who receive health care benefits pursuant to the San Francisco Health Care Accountability Ordinance (HCAO)

A Reminder about the Waiver Form

The Employee Voluntary Waiver Form permits employees to voluntarily waive their right to employer health care expenditures under the HCSO. Employers must use the exact form and may not change the form in any way. Full details here.

For more details the HCSO requirements employees who waive the health plan but do not complete the HCSO waiver, see our prior posts:

For more information on all of the HSCO requirements directly from the City, check out the SF OLSE’s official HSCO website.

Newfront San Francisco Health Care Security Ordinance (HCSO) Guide.

Karen Hooper

VP, Senior Compliance Manager

Karen Hooper, CEBS, CMS, Fellow, is a Vice President and Senior Compliance Manager working closely with the Lead Benefit Counsel in Newfront's Employee Benefits division. She works closely with internal staff and clients regarding compliance issues, providing information, education and training.