Taxation of Wellness Program Gift Cards

By Brian Gilmore | Published September 27, 2019

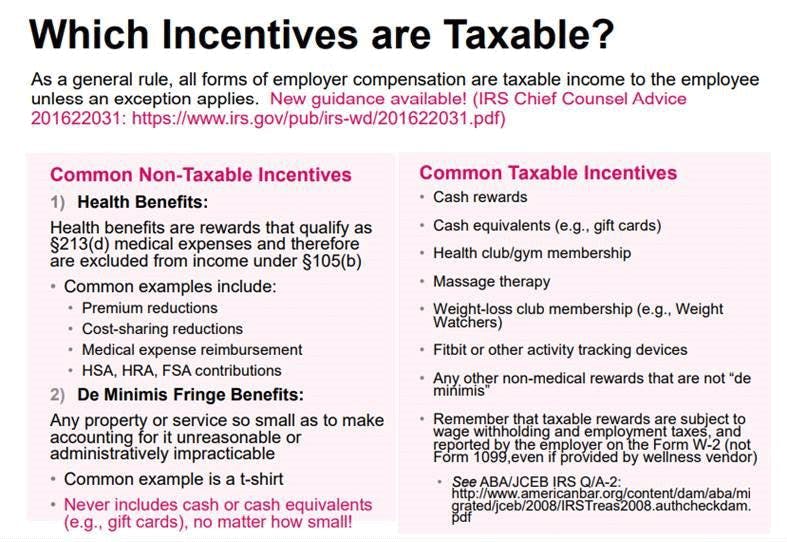

Question: Are gift card rewards from a wellness program always taxable income to the employee? Are there any non-taxable alternatives?

Short Answer: Yes, gift cards are always taxable income to employees. Alternatives include de minimis non-cash-equivalent items or health benefit rewards.

General Rule: All Cash or Cash Equivalent Compensation is Taxable

Any form of compensation provided in the form of cash or cash equivalents (e.g., gift cards or gift certificates) is always standard taxable income subject to withholding and payroll taxes and reported on the Form W-2.

This is derived from the standard tax requirements that all compensation is taxable unless an exception applies. No exception applies to cash or cash equivalent wellness program rewards.

For more details on other non-cash-equivalent taxable benefits, see our previous post: Taxation of Gym Reimbursement Arrangements.

Third-Party Vendor Payments Reported on Form W-2

Where a third-party vendor distributes wellness program gift card rewards, the taxable income is subject to withholding and payroll taxes through the employer’s payroll, and it is reported by the employer on the Form W-2.

In other words, wellness program gift cards are never reported on a Form 1099, even if the wellness program vendor provides the gift cards to employees.

Non-Taxable: De Minimis Non-Cash and Non-Cash Equivalent Items

For rewards that are not cash or cash equivalents, the main situation where you could avoid taxation is if the reward is considered “de minimis.” De minimis rewards are very small rewards that are too small to reasonably account for, or where it would be administratively impracticable to account for them (and are not cash or cash equivalents).

Although there is no bright line rule on what qualifies as de minimis, IRS guidance suggests somewhere in the neighborhood of $25 in fair market value would be a reasonable limit. Common examples include t-shirts and water bottles.

Keep in mind that cash or cash equivalents (e.g., gift cards) are always taxable and never considered de minimis (no matter the amount).

Non-Taxable: Health Benefits

If the employer wants to avoid taxation on the amounts, some good health benefit options are:

Increasing the employer-share of the premium;

Increasing the employer HSA or HRA contribution amount; and/or

Providing an employer contribution to the health FSA of up to $500.

All of those would be non-taxable to the employee through the standard exclusions for health benefits.

Regulations

Treas. Reg. §1.132-6(a):

(a) In general. Gross income does not include the value of a de minimis fringe provided to an employee. The term “de minimis fringe” means any property or service the value of which is (after taking into account the frequency with which similar fringes are provided by the employer to the employer’s employees) so small as to make accounting for it unreasonable or administratively impracticable.

IRS Publication 15-B:https://www.irs.gov/pub/irs-pdf/p15b.pdf

De Minimis (Minimal) Benefits

You can exclude the value of a de minimis benefit you provide to an employee from the employee’s wages.** A de minimis benefit is any property or service you provide to an employee that has so little value (taking into account how frequently you provide similar benefits to your employees) that accounting for it would be unreasonable or administratively impracticable. Cash and cash equivalent fringe benefits (for example, gift certificates, gift cards, and the use of a charge card or credit card), no matter how little, are never excludable as a de minimis benefit.** However, meal money and local transportation fare, if provided on an occasional basis and because of overtime work, may be excluded as discussed later.

IRS Publication 5137:

https://www.irs.gov/pub/irs-pdf/p5137.pdf

Examples of Excludable De Minimis Fringe Benefits

All of the following may be excludable if they are occasional or infrequent, not routine:

Personal use of photocopier (no more than 15% of total use)

Group meals, employee picnics

Theater or sporting event tickets

Occasional coffee, doughnuts, or soft drinks

Flowers or fruit for special circumstances

Local telephone calls

Traditional birthday or holiday gifts (not cash) with a low FMV

Commuting use of employer’s car if no more than once per month

Employer-provided local transportation

Personal use of cell phone provided by employer primarily for a business purpose

Benefits That Do Not Quality as De Minimis

The following are common examples of benefits that do not qualify as de minimis:

Cash – except for infrequent meal money to allow overtime work (see below)

Cash equivalent (i.e., savings bond, gift certificate)

Certain transportation passes or costs

Use of employer’s apartment, vacation home, boat

Commuting use of employer’s vehicle more than once a month

Membership in a country club or athletic facility

JCEB IRS Q/A (May 2008):

http://www.americanbar.org/content/dam/aba/migrated/jceb/2008/IRSTreas2008.authcheckdam.pdf

§ 104, § 105, § 106, § 132 – Wellness Programs

An employer hires Provider A to run a wellness program for its employees. The wellness program

is distinct from the employer’s group health plans. Under the wellness program, if an employee

completes a health risk assessment, Provider A sends the employee a $50 gift card.

…

IRS Response: The Service representative agrees that the gift cards are taxable income, but

disagrees that the gift cards should be reported on Form 1099-MISC. The Service representative stated that this is compensation that should be reported on Form W-2 by the original employer, not

by Provider A who is acting as an agent in providing compensation to the employees.

Brian Gilmore

Lead Benefits Counsel, VP, Newfront

Brian Gilmore is the Lead Benefits Counsel at Newfront. He assists clients on a wide variety of employee benefits compliance issues. The primary areas of his practice include ERISA, ACA, COBRA, HIPAA, Section 125 Cafeteria Plans, and 401(k) plans. Brian also presents regularly at trade events and in webinars on current hot topics in employee benefits law.

Connect on LinkedIn